What is ABN?

In Australia, ABN (Australian Business Number) is a unique number used to identify a business, just like a person’s ID card. Your own ABN will be associated with your other information, such as the Australian Taxation Office (ATO) and other government agencies to monitor your income and tax returns. In the following article, we get to know about How to apply for an ABN? So don’t skip the article from anywhere and read it carefully because it’s going to be very useful for you guys.

Why do we need ABN?

Whether you are a student or a tourist on a holiday visa, you may need an ABN in Australia. There are many companies and employers in Australia that are more inclined to use ABN to work with you for “company-to-company” cooperation, rather than hiring you as an employee. Because in this case, the company employer does not need to help you pay super (Australian pension), and if it is a more mobile job, it is more conducive to their management of personnel.

There are many jobs that use ABN locally in Australia, such as the farms and factories were tourist visas like to work. International students may choose housekeepers who work part-time, or local people who work in construction, cleaning, babysitting, etc. will use it. . It is a very common way of employment in Australia.

How to apply for ABN?

ABN currently only has an online application method, which is free like TFN (tax number). After completing the application and passing the review, you will immediately get your ABN number.

Next, let’s take it to step by step~

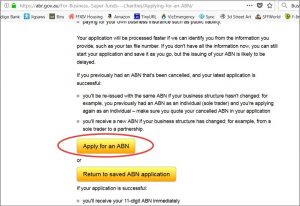

STEP 1 Log in to the website

Open the webpage and click the yellow button~

STEP 2 Information confirmation

Tick the small box and click Next

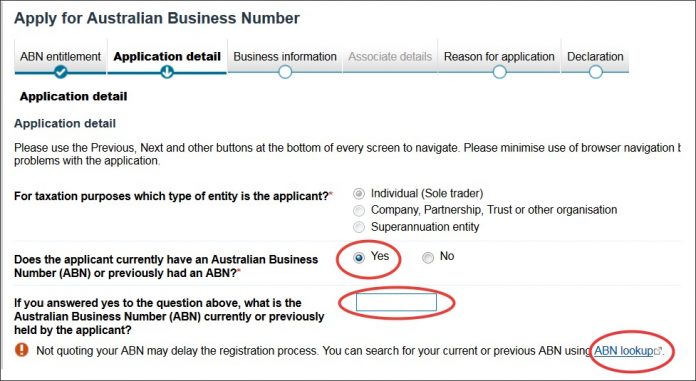

STEP 3 Basic information confirmation

Choose individual for the type, choose Yes for all the questions you answer, and finally choose the field you need

STEP 4 Confirm the information you filled in

You don’t need to do anything, just confirm it, just go to Next~

STEP 5 Tax number related issues

The answer according to the actual situation, whether there is an ABN before, or whether there is a tax number, you need to fill in truthfully.

STEP 6 Tax-related issues

For this question, you must choose Yes and be a legal taxpayer in Tuxian and Australia.

STEP 7 personal basic information

Fill in your name and date of birth~

STEP 8 Start date and field

Just fill in the start date, work content and select the work area, the last question is NO

STEP 9 Personal contact information

Write clearly your address and email address

STEP 10 Contact information

The contact person is usually yourself, fill in your name, mobile phone number, and email address again.

STEP 11 Reasons for application

Generally, you can choose Contractor for part-time work, and choose Yes~ for the following options.

STEP 12 Fill in the declaration

Just fill in the name, Sole Trader and date, and the submission is complete~

Then, you immediately have your own ABN~

Also read: how to cure a hangover

When you’re trying to spy on someone’s phone, you need to make sure the software isn’t found by them once it’s installed.